Content

Non-https://intuit-payroll.org/ Expenses is usually non-recurring and does not include day-to-day business costs. Non-operating income is any profit or loss generated by activities outside of the core operating activities of a business. The concept is used by outside analysts, who strip away the effects of these items in order to determine the profitability of a company’s core operations. When a company experiences a sudden spike or decline in its reported income, this is likely to have been caused by non-operating income, since core earnings tend to be relatively stable over time. Non-operating income includes the gains and losses generated by other activities or factors unrelated to its core business operations.

- Operating income is also used to look at operating margins, as this is usually an easier way to compare performance YoY or versus competitors.

- In contrast, the gains are categorized as non-operating if a technology company sells or spins off one of its divisions for $400 million in cash and shares.

- If you have a specific career goal in mind, your operating income can give you the information you need to plan for it.

- In this article, you’ll learn about operating revenue in particular, how to calculate it, and examples of operating revenue for different types of businesses.

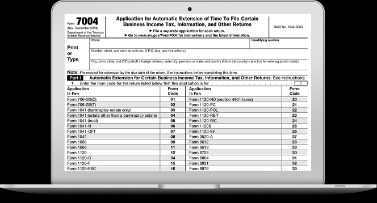

- Bill is working on refinancing his current loans with a new bank, so he has to prepare a multiple step income statement with a detailed operating section.

These types of sales don’t impact day-to-day business activity and aren’t included in operating revenue since they aren’t generated from the company’s core operations. The operating income is the profit the business earns after deducting operating expenses. It refers to the revenue and expenses resulting from the company’s core business and includes selling, general and administrative expenses. Operating income is an accounting figure that measures the amount of profit realized from a business’s operations, after deductingoperating expensessuch as wages, depreciation, andcost of goods sold.

Net Income FAQs

The balance sheet reports retained earnings, which owners can use to draw funds from the business. It’s important to note that operating costs are different from other expenses. For instance, there are one-time or unusual costs like interest, lawsuit expenses, depreciation, or obsolete inventory costs. These are known as non-operating expenses and would not be considered in an operating income calculation. To calculate income from operations, just take a company’s gross income and subtract the operating expenses.

It’s important that you’re in tune with your business’s ability to generate a profit on its own. Track this metric over time so you can see when your business is becoming more or less profitable and then dig into why. OCF is different from free cash flow because FCF accounts for capital expenditures , while OCF does not. Arming yourself with a little accounting know-how can keep you in control of your business finances, making sure you stay profitable in the short- and long-term.

Operating Income Definition

Operating revenue refers to the money a company generates from its primary business activities. Non-Operating Expenses or non-recurring costs are financial obligations not related to core business operations. These expenses include legal fees, interest payments, loss from selling assets, reorg costs, currency exchange rates, and other one-time or unusual costs. Many non-operating gains or losses are non-recurring, which leaves room for accounting manipulation. A company may record a high non-operating income to hide its poor performance on core operations. It may also manipulate its operating income by including gains incurred by activities unrelated to the core business.

If you add the non-operating income to the operating income, you can calculate the company’s earnings before tax. In case non-operating gains are bigger than non-operating losses, the company reports a positive non-operating income. Non-operating income is the profit or loss a business earns outside of its core operating activities. Some non-operating items are recurring in nature but are still considered non-operating as they do not form the core business activities of the entity.

Example of Operating Income Calculation

However, if non-operating income is negative, it reduces profit and has the opposite impact on the company. Non-operating income is included in earnings even if it is not part of the primary operation. When NOI exceeds operating income, it casts doubt on the organization’s operations and activities, and investors may lose interest in investing.

- A company adopts strategies to reduce costs or raise income to improve its bottom line.

- A sudden, substantial increase in profit could be caused by by the inclusion of non-operating income.

- The cost of goods sold is any cost incurred in the production of the goods sold to generate revenue.

- Not all money flowing into your business counts as revenue, and there aredifferent types of revenue.

- The main operations of retail stores are the purchasing and selling of merchandise, which requires a lot of cash on hand and liquid assets.

- The net operating income formula should be used to make real estate decisions.

Bill’s Sandwich Shop makes some of the best subs and grinders in the Philadelphia area. Bill is working on refinancing his current loans with a new bank, so he has to prepare a multiple Non Operating Income Example, Formula income statement with a detailed operating section. Assets America was incredibly helpful and professional in assisting us in purchasing our property.

Operational Expenses

Moreover, NOI includes only the expenses directly related to the running of your properties. Net income includes all expenses, plus capital gains/losses and extraordinary items. A positive NOI and negative NI indicates non-operational problems with the business, such as financing. Overall, while analyzing total revenue is useful, it isn’t the only calculation business owners should be making. On the contrary, it’s vital to thoroughly examine all aspects of your business’s financial health, including its operating income. Operating expenses are only the expenses needed to operate the property.

- It’s critical to distinguish between a company’s capacity to profit from its primary business and other activities or aspects when assessing its true success.

- The operating margin is the ratio between a company’s operating income and its revenue generated in the corresponding period.

- Linda wants to understand if her business is profitable after deducting all the costs of running it.

- Non-operating income refers to the income that is not attributable to the company’s core business operations.

- For most business entities, a net operating income percentage of 20% or more is considered good.

This is a back-calculation to decipher the value of non-operating income and expenses from the entity’s income statement. Some companies report such income and expenses under a different head. S-X 5-03 and prescribe separate income statement line item captions for non-operating income and non-operating expense. Many SEC registrants prefer to show one line item for non-operating income and expense on a net basis. Note that it is not the net balance that determines materiality, but the offsetting gross amounts. You calculate annual incremental NOI as net operating assets minus net operating expenses for the year. Naturally, it excludes the items not found in NOI, such as income tax and interest expense.

Non-operating income definition

But a net operating income percentage of 10% or less may be considered good for a long-term care facility. This is because the expenses for a long-term care facility are typically higher than those for retail property. When looking at the results of calculating the net operating income of a property there are only two ways to interpret the data, it’s either good or bad. You will want to calculate the net operating income of each property to determine which will be the best investment. Ultimately, investors should also assess net or bottom-line profits, in addition to operating income. This is why many investors consider operating income to be a more reliable measure of profits than net income, or “bottom line” profits. The biggest non-operating expense items are taxes and interest, but there’s also a category called “other (non-operating) income or expenses.”

Finally, their maintenance and repairs would be $30,000, while their insurance costs are $4,000. Operating income helps you understand how well the company is running its core operations, before financial costs like capital structure and taxes are deducted. They are similar, but EBIT includes any non-operating income as well as expenses from non-core business functions, such as investments in other companies. If there are none of these, operating income and EBIT may be the same. Operating income is an earnings “level” on the income statement, sitting below the operational part of the income statement. It’s the next level of revenue refinement after gross profit since it includes the non-direct costs of creating the revenue. By itself, operating income doesn’t provide a complete picture of profit.